Welcome to Financial Mastery

Your Complete Finance Solution

Explore our Finance Management System suite, designed to simplify and streamline your financial processes. From creating proposals to managing expenses, our robust tools empower you to take control of your finances with confidence.

Estimates

Accurate Project Budgeting

Estimate project costs with precision using our Estimates module. Ensure that your financial planning aligns perfectly with your project goals.

Craft Irresistible Offers

Our Proposal module enables you to create compelling and professional proposals that leave a lasting impression. Impress clients and win contracts with ease.

Customizable Templates

Tailor proposals to your brand and client needs.

Client Interaction

Receive feedback and comments directly on the proposal.

Interactive Elements

Enhance proposals with images, tables, and other interactive features.

Version Control

Keep track of proposal revisions for a seamless collaboration process.

Bank Account

Centralized Financial Control

Our Bank Account module provides a centralized view of your financial transactions, ensuring that you have complete control over your accounts.

Flexible Financial Adjustments

Create credit notes effortlessly with our Credit Note module. Adjust invoices and maintain a transparent and flexible financial record.

Streamlined Expense Management

Efficiently manage and track business expenses with our Expenses module. Gain insights into your spending patterns for better financial planning.

Expense Categories

Categorize expenses for accurate reporting.

Receipt Uploads

Attach receipts for transparent and accountable expense tracking.

Approval Workflow

Streamline the approval process for expense reimbursement.

Seamless Invoicing

Create and manage invoices effortlessly with our Invoices module. Get paid on time and maintain a healthy cash flow for your business.

5 Star Customer • Support

Need Help?

The Proposal module streamlines the creation process by offering customizable templates that allow users to quickly tailor proposals to match their brand and client needs. With interactive elements, version control, and direct client interaction features, users can enhance their proposals, collaborate seamlessly on revisions, and receive feedback efficiently, significantly reducing the time and effort typically required to create compelling proposals.

Yes, the Estimates module is designed to accommodate complex project budgets with ease. It allows for detailed line item breakdowns, ensuring transparency and accuracy in estimates. The module supports a streamlined client approval workflow, facilitating quicker project initiation. Additionally, it offers the flexibility to adjust estimates as needed and effortlessly convert approved estimates into invoices, accommodating any project size or complexity.

Our Invoices module stands out due to its emphasis on customization, automation, and flexibility. It offers professional invoice templates that can be customized to reflect your brand, automatic reminders to ensure timely payments, and the capability to set up recurring invoices for ongoing services. Moreover, its unique feature to convert invoices into credit notes adds an additional layer of financial management flexibility, setting it apart from standard invoicing software.

Security is a top priority for our Payments module. It supports secure transactions through reputable gateways like PayPal and Stripe, employing advanced encryption and compliance measures to protect sensitive financial information. The module also provides real-time transaction tracking and automatic payment acknowledgments, ensuring a safe and transparent payment process for both businesses and their clients.

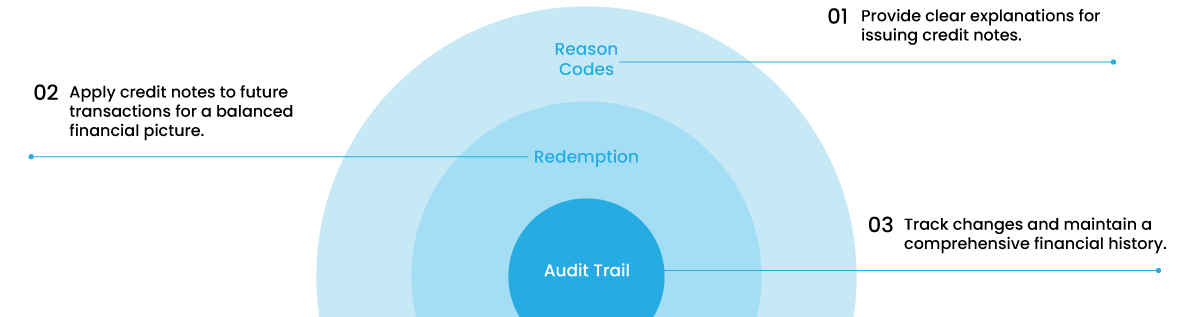

The Credit Note module aids financial adjustments by providing a straightforward way to issue credit notes for invoice adjustments, returns, or cancellations. It includes reason codes for transparency, allows for the application of credit notes to future transactions, and maintains an audit trail for financial history. This module simplifies managing financial adjustments, ensuring accuracy and maintaining trust between businesses and their clients.