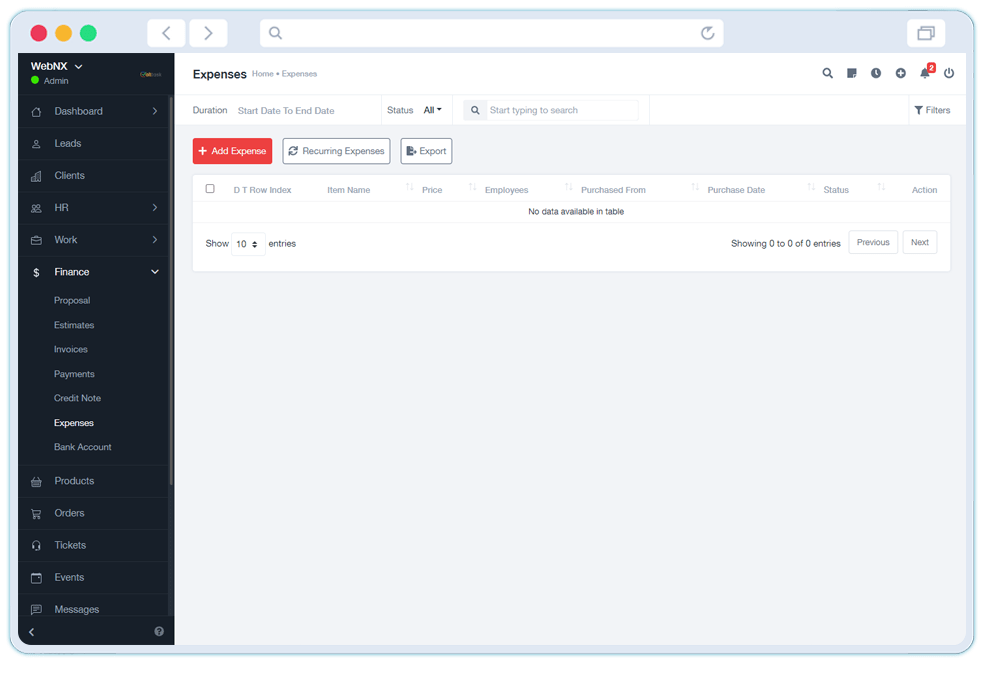

Expenses Management

Streamlining Business Expense Tracking

Welcome to our Expenses Management, a comprehensive solution designed to streamline the management and tracking of business expenses efficiently. Whether you need to categorize expenses, attach receipts for transparency, or implement an approval workflow for reimbursement, our module provides the tools to gain insights into spending patterns for better financial planning.

Features

Expense Categories

Enhance accuracy in reporting by categorizing expenses into relevant categories. Our module allows you to create and customize expense categories, providing a systematic approach to tracking and analyzing spending patterns.

Customizable Categories: Create expense categories that align with your business needs and reporting requirements.

Accurate Reporting: Categorize expenses for precise and detailed financial reporting.

Receipt Uploads

Promote transparency and accountability by attaching receipts to expense records. Our module supports the upload of receipts, ensuring that each expense is backed by documented proof for auditing and reporting purposes.

Documented Proof: Attach digital or scanned receipts to expense records for transparency.

Audit Trail: Maintain a comprehensive audit trail with receipt uploads for each expense.

Approval Workflow

Streamline the expense approval process for efficient reimbursement. Our module facilitates the implementation of an approval workflow, ensuring that expenses are reviewed and approved systematically before reimbursement.

Customizable Approval Processes: Define approval workflows based on organizational hierarchy and policies.

Automated Notifications: Receive automated notifications for pending approvals, expediting the reimbursement process.

How It Works

Expense Categories

Create and customize expense categories for accurate reporting and tracking.

Receipt Uploads

Attach receipts to expense records for transparency and accountability.

Approval Workflow

Implement a customizable approval workflow to streamline the expense reimbursement process.

Why Choose Our Expenses Management?

Accuracy

Enhance accuracy in financial reporting by categorizing expenses systematically.

Efficiency

Streamline the approval process with a customizable workflow for efficient reimbursement.

Insights

Gain insights into spending patterns for better financial planning and decision-making.

Transparency

Promote transparency and accountability by attaching receipts to expense records.

5 Star Customer • Support

Need Help?

Yes, the expense categories are highly customizable. You can add, remove, or modify categories at any time to align with your business needs and financial reporting requirements. This flexibility ensures that the module remains relevant and useful as your business evolves.

While there might be default limits set for the size or type of receipt files to ensure optimal performance, these are generally sufficient for typical receipt images or documents. Accepted file types usually include JPEG, PNG, PDF, and others. Specific size limits will be detailed in the module's documentation or settings.

The approval workflow is designed to accommodate multiple levels of approval, reflecting your organization's hierarchy or specific policies. You can customize the workflow to include as many steps as necessary, ensuring that all relevant parties review and approve expenses before reimbursement. Automated notifications keep the process moving efficiently by alerting approvers when their review is needed.

Integration capabilities depend on the specific systems in use and the module's design. Generally, our module is built to allow for integration with popular accounting and payroll systems to streamline financial processes further. We recommend consulting with our support team for detailed information on integrating with your existing systems.

We prioritize the security of all data within the Expenses Management Module. Measures include encryption of data in transit and at rest, regular security audits, and compliance with data protection regulations. Access controls and authentication processes further ensure that only authorized users can view or modify sensitive financial data.